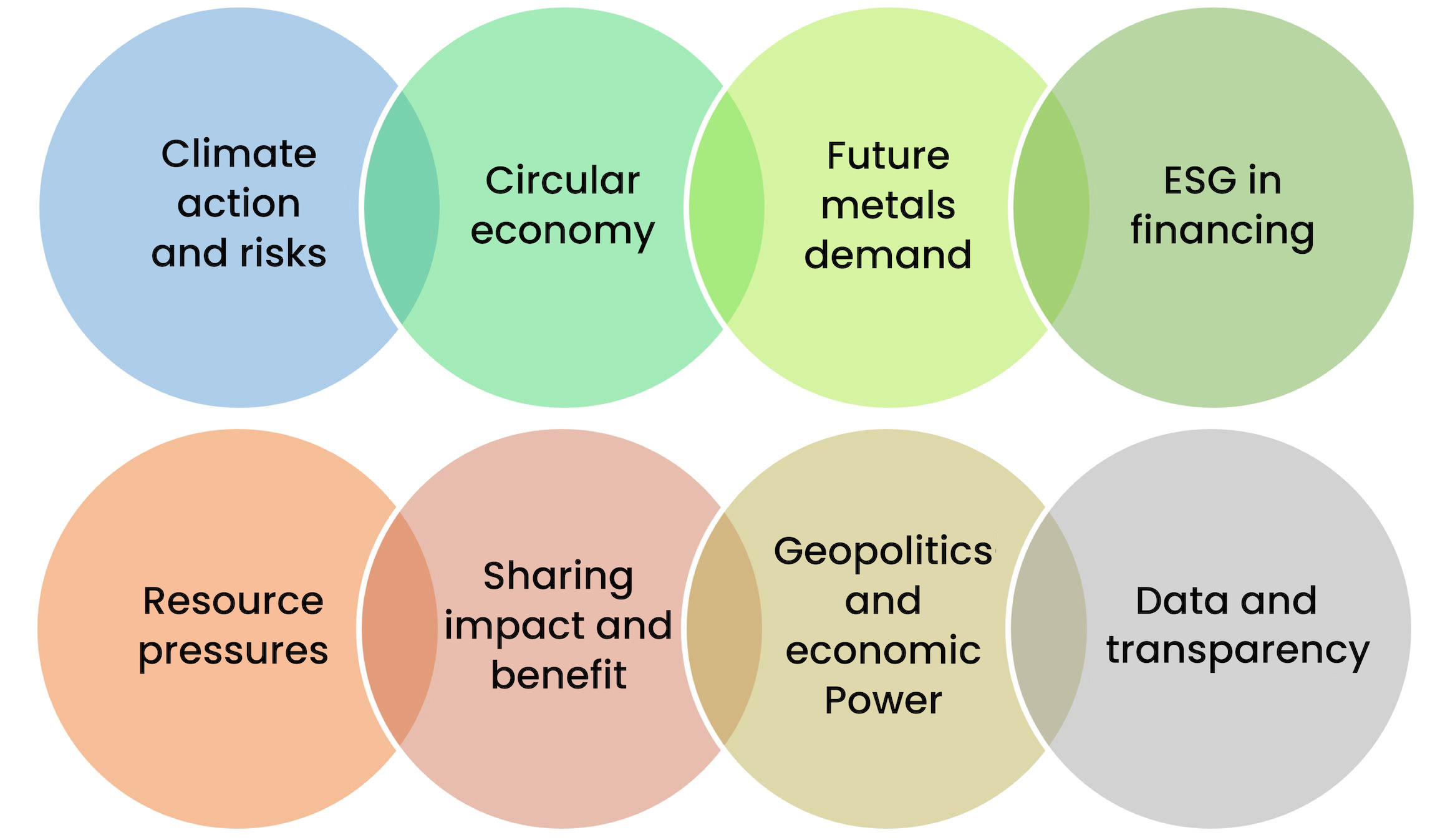

Climate action and risks

‘Part of the problem and the solution.’

Aluminium needs to delink growth and emissions through: decarbonisation of electricity; direct emissions reductions; recycling and resource efficiency.

Climate impacts (environmental and social) are already visible and demand for action is accelerating. Climate risks include impacts on industry itself.

Circular economy

‘Closing all loops.’

Need to reduce sourcing from virgin materials, increase recycled content and remanufacturing, and generally rethink the material economy.

Current EOL aluminium product collection rates ~70%, increase of 10% in last 10 years. Waste streams must also be addressed e.g. bauxite residue, SPL in primary production.

Future metals demand

‘Footprint from a boom.’

Aluminium demand growth projected to increase 80% by 2050.

Drivers include rapid urbanisation, EV transition, electrical grid expansion to support renewables, replacing plastics in packaging.

Expect increased scrutiny of scaling commodities and their impacts.

ESG in financing

‘From alternative to mainstream.’

ESG performance will be rewarded through access to, and cost of, capital and company valuation.

Social will increase in focus in coming years.

Novel financing and production models to limit risk, growth in JVs and service agreements.

Standardisation and clarity of ESG metrics needed.

Resource pressures

‘Nowhere without challenges.’

Increasing strains on the world’s resources including water, biodiversity and ecosystems.

Societies will be forced to more aggressively confront resource constraints and global limits.

Access to bauxite tends to be assumed, but supply chains face growing customer and regulatory due diligence.

Sharing impact and benefit

‘New models needed.’

Many social and environmental risks and externalities of mineral and metal production.

Local opposition to mining and refining will increase if no new business models are developed that benefit affected communities, particularly Indigenous peoples.

Lack of good post-closure remediation is leaving poor legacy.

Geopolitics and economic power

‘Unilateral efforts won’t cut it.’

Rise in economic protectionism, trade disputes/wars, local content laws for mineral processing.

Dominance of China across many metals.

Increasing economic power in developing regions eg India, Africa.

Global affairs will become more pluralistic, influenced through soft power and alliances.

Data and Transparency

‘Show me.’

Growing disclosures of non-financial data are guiding decision-making, procurement and enabling market differentiation / fragmentation on ESG.

How to maximise standardisation, usefulness and impact of data. ‘Blockchain’ type models still nascent. Data security remains an arms race.