M&E Insights, July 2021

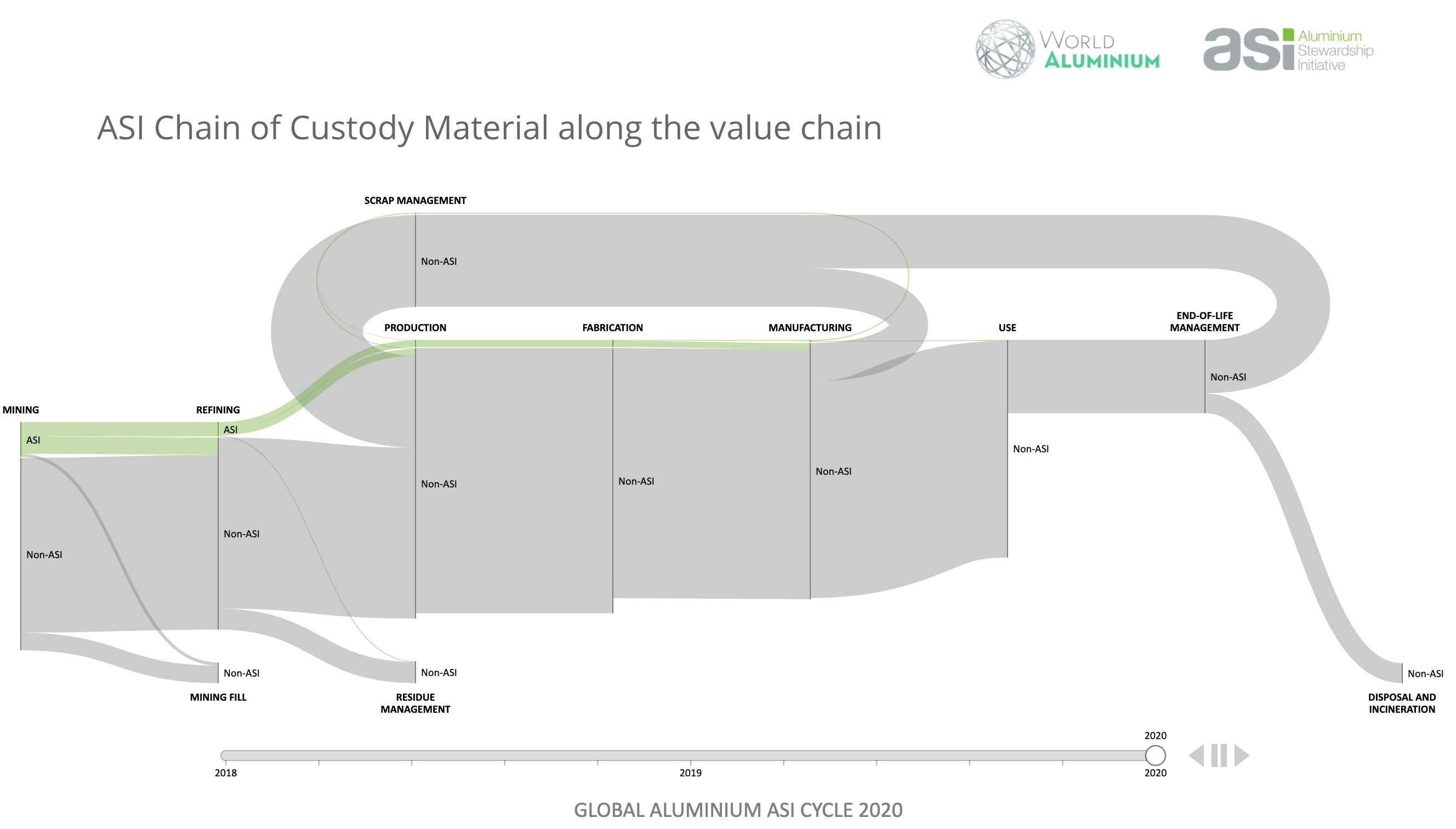

ASI has published a second year of ASI Chain of Custody flows data, visualised in the context of aluminium global supply and demand. The visualisation, updated with 2020 data reported by more than double the number of CoC Certified Entities than there were in 2019, shows how annual flows of CoC Material are growing over time and through the global value chain.

As part of the CoC Standard, Certified Entities are required to account for and report to ASI the volumes of CoC Material (including Eligible Scrap) they purchase and sell, and the share this makes up of their total material inputs and outputs. With this data, ASI’s Monitoring & Evaluation team are able to show annual flows of CoC Material and how this is changing over time and through the global value chain. The first visualisation of this data for 2019 was announced in the January 2021 M&E Insights article.

The last 18 months have seen significant growth in CoC Certifications (Evidence of growing ASI Certification uptake along the aluminium value chain), following Entities’ initial Performance Standard certifications, but what does this mean in terms of the availability of CoC Material, including ASI Aluminium, at each stage in the value chain and to final product manufacturers (and ultimately consumers themselves)?

The data collected and analysed from the year 2020 from 27 Entities — more than double the number reporting 2019 data — has at least 5 reporters represented at each production stage. Depending on their date of ASI Certification, 2020 also represents the first full year data for a number of (but not all) Entities.

The updated ASI Chain of Custody Material Flows visualisation shows that ASI Material outputs are still highest from bauxite mining (approx. 59 million tonnes bauxite), with each subsequent supply chain stage reducing in volume by around 50%, when expressed as aluminium equivalents. Around 9 Mt of alumina are output as ASI Material and 2.4 Mt primary aluminium, with 350kt making its way into fabricated goods (including 190kt of Eligible Scrap). These volumes translate to around 15% of global bauxite production, 7% of alumina, 3% of primary aluminium, 3% of fabricated goods, and 1% of Eligible Scrap. This is to be expected, as available supply must be built to enable the subsequent supply chain stage to source.

This represents an increase on 2019 values in both volume and share of ASI Material at all stages in the value chain, reflecting increased certification and supply. The first year’s data includes partial year reporting from nearly all Entities, while 2020 represents full year reporting from some and partial from others (i.e., those which certified part way through the year). Therefore, care should be taken when interpreting changes from one year to the next due to partial year reporting. What can be seen, however is that growth in output (and input) of ASI Material is faster in the upstream parts of the value chain than the downstream.

As customers and consumers increasingly seek assurance that the aluminium in their products is responsibly sourced, it is becoming clear that downstream industry is preparing to meet this demand: the fastest growth in CoC Certification is in the post-casthouse manufacturing stages and the upstream industry is increasing the availability of ASI Material. Joining up this growing supply with increasing demand is a task for all actors in the aluminium value chain.

With these published data, ASI continues to demonstrate its commitment to transparency and whole of supply chain uptake and impact. We look forward to building on this strong start and invite all interested supply chain actors and stakeholders to contribute to this momentum.

We sincerely thank IAI for their collaboration and support and all reporting CoC Certified Entities for their positive engagement.

For more information on ASI CoC Material Flows, contact Klaudia Michalska, ASI Impacts Analyst.

Stay tuned for our next M&E Insights article coming in the August newsletter!