Finance and investment sector update: ASI’s engagement with ICMA

As part of our finance and investment sector engagement work, ASI is an observer member of the International Capital Market Association (ICMA). Here, we provide an update of related recent activity in the sustainability financing space.

27 July 2023

In June, ICMA released updated editions of 1) the Climate Transition Finance Handbook (CTFH), 2) the Sustainability-Linked Bond Principles and 3) the Key Performance Indicator (KPI) registry. ASI participated in working groups on these updates.

The release of these materials followed the ICMA AGM and Conference in May, attended by around 1,200 senior capital market representatives and industry leaders, along with public sector officials, regulators and academics.

1) ICMA publishes updated sustainability financing guidance documents

First, the 2023 edition of the CTFH integrates the progress made by the market and the official sector on climate transition guidance and disclosures. The document includes recommendations for climate-themed green, sustainability and sustainability-linked bonds and acknowledges the development of “climate transition” bonds in certain jurisdictions. It includes new annexes with illustrative disclosures, infographics and a list of wider market and official sector guidance for climate-themed bonds.

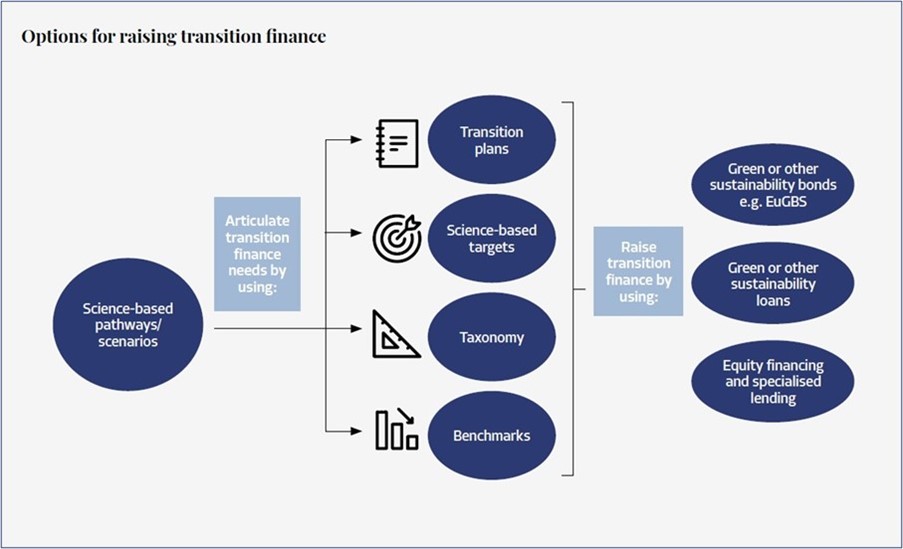

Second, the Sustainability-Linked Bond Principles are a global standard for the sustainable bond market. This is expected to be an increasingly accessed financial framework in future for the global aluminium value chain, as it seeks to decarbonise and meet other sustainability goals and targets. The Principles provide important additional guidance on climate transition finance, aiming to increase its availability at scale to fund transition, especially in the hard-to-abate industries, such as aluminium. The green, social, sustainability and sustainability-linked bond market aims to enable and develop the key role debt markets can play in funding projects that contribute to environmental sustainability and socio-economic challenges globally. Below is an illustration from the European Commission on how to use sustainable finance for the transition.

Source: Annex of EU Commission recommendation on facilitating finance for the transition

And last, the illustrative KPIs registry includes a number of references to ASI in the Global Benchmarks for calibration of targets.

2) Key Takeaways from ICMA’s 2023 AGM and Conference

The release of these materials followed the ICMA AGM and Conference in May, attended by around 1,200 senior capital market representatives and industry leaders, along with public sector officials, regulators and academics. The programme featured high-level speakers and delegates, who provided insights on the current state and prospects for capital markets, with a special focus on financial stability, sustainability, regulatory change and FinTech developments.

An important part of the conference was the recognition of the key role of capital markets in tackling climate transition. It was noted that climate transition is a game changer for society and economies. It was also recognised that there are significant opportunities to scale-up sustainable finance. Whilst ESG bonds for instance have experienced significant year-on-year growth, they still represent a fraction of total global bonds issued in 2022.

It was also noted that whilst further progress on decarbonisation is very important, this should not be at the expense of other ESG factors. Financial support for social projects to protect the most vulnerable were also critical and would help societies overall become more prosperous and cohesive. Credit risks remain and these may cause some challenges for parts of the aluminium value chain to be able to fund ESG improvements.

Panellists at the conference underlined the importance of good quality, comparable and internationally consistent corporate data with a special emphasis on transition plans. Quality data availability was seen as a limiting factor, with more digitalisation needed. Disclosure and transparency by issuers are critical. Whilst reduction targets should be sufficiently ambitious to achieve meaningful change and avoid “greenwashing” claims, they also should not be unrealistic and need to be supported by proper plans. The role of external verification of disclosures, methodology and targets was also highlighted.

ASI continues its engagement with ICMA to support close co-operation between key finance and investment sector stakeholders. Collaboration among investors, borrowers/issuers, third party framework and methodology developers and verifiers and local communities is needed to accelerate progress in the financing of ESG improvements while ensuring all needs are met.

Please contact Andrew Wood, ASI Director of Sustainable Investment and Legal, if you have any questions or comments in this area.

RELATED TOPICS:

SHARE THIS ARTICLE