Tracking ASI Certified Material: 2023 Data Highlights and Reporting Insights

In the global context of IAI’s material flow modelling, the flow of ASI CoC Material remained consistent with last year’s trends.

27 August 2024

The 2023 data shows that while there has been a year-on-year increase in actual CoC Material volumes, global production has also increased, so the proportion within the global context remains consistent with 2022, with only minor percentage changes (±1%) at individual supply chain stages. There were 82 CoC Certified Entities in total in 2023, an increase from 68 Entities in 2022. Three of these Entities did not submit their CoC Annual Reports for 2023 from the Industrial Users membership class. One Entity was newly certified in 2023, and two others did not report any volumes of material in the previous years, so their omission is deemed to have minimal impact on the aggregated figures.

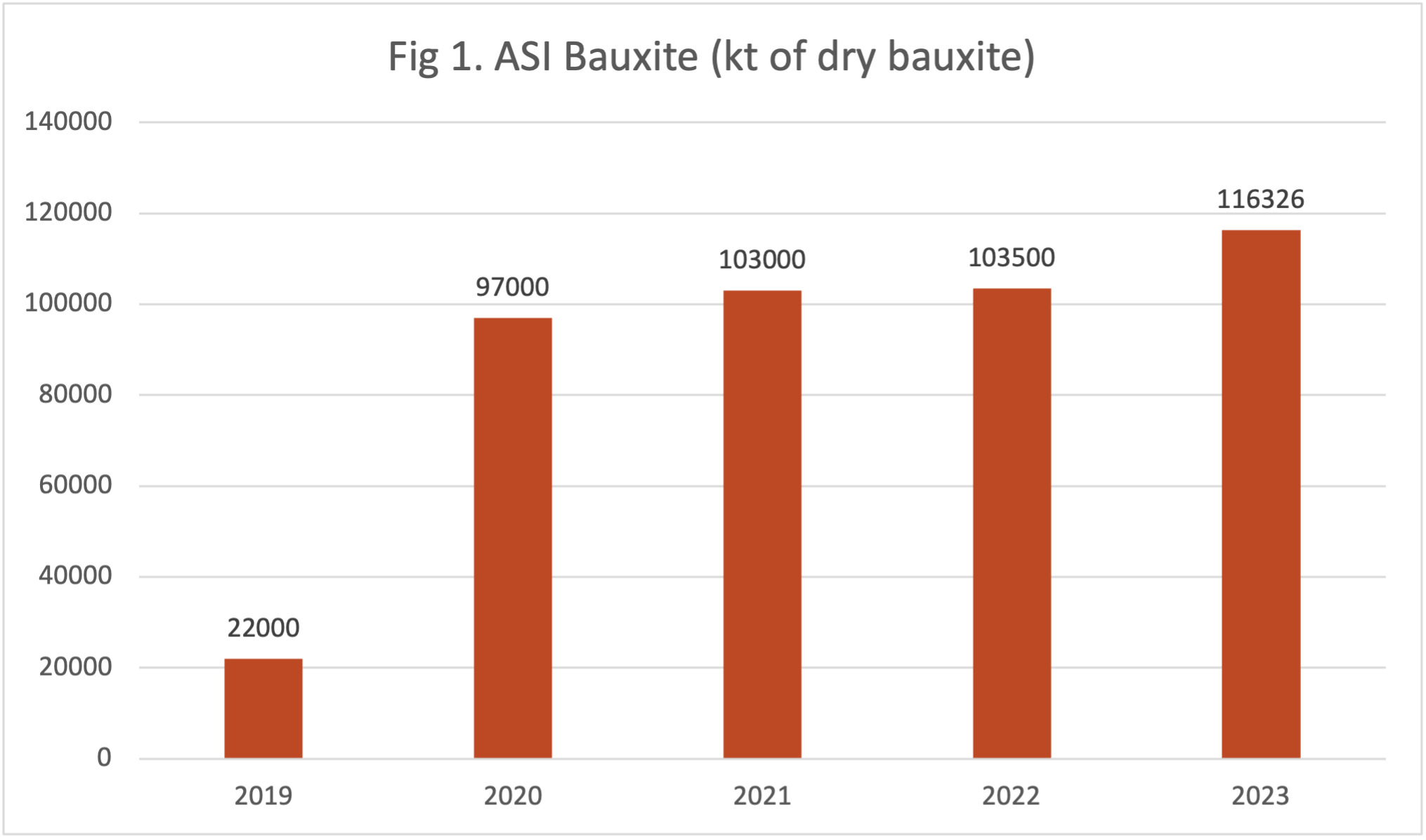

Bauxite production

Bauxite production from CoC Certified mines accounts for approximately 26% of global bauxite production, a slight increase from the previous year (see Figure 1). This stability over recent years reflects relatively consistent production from the pool of CoC Certified mines. Increases tend to occur when new mines join this pool, and in 2023, two new Entities producing bauxite achieved CoC Certification.

Bauxite production from CoC Certified mines accounts for approximately 26% of global bauxite production, a slight increase from the previous year.

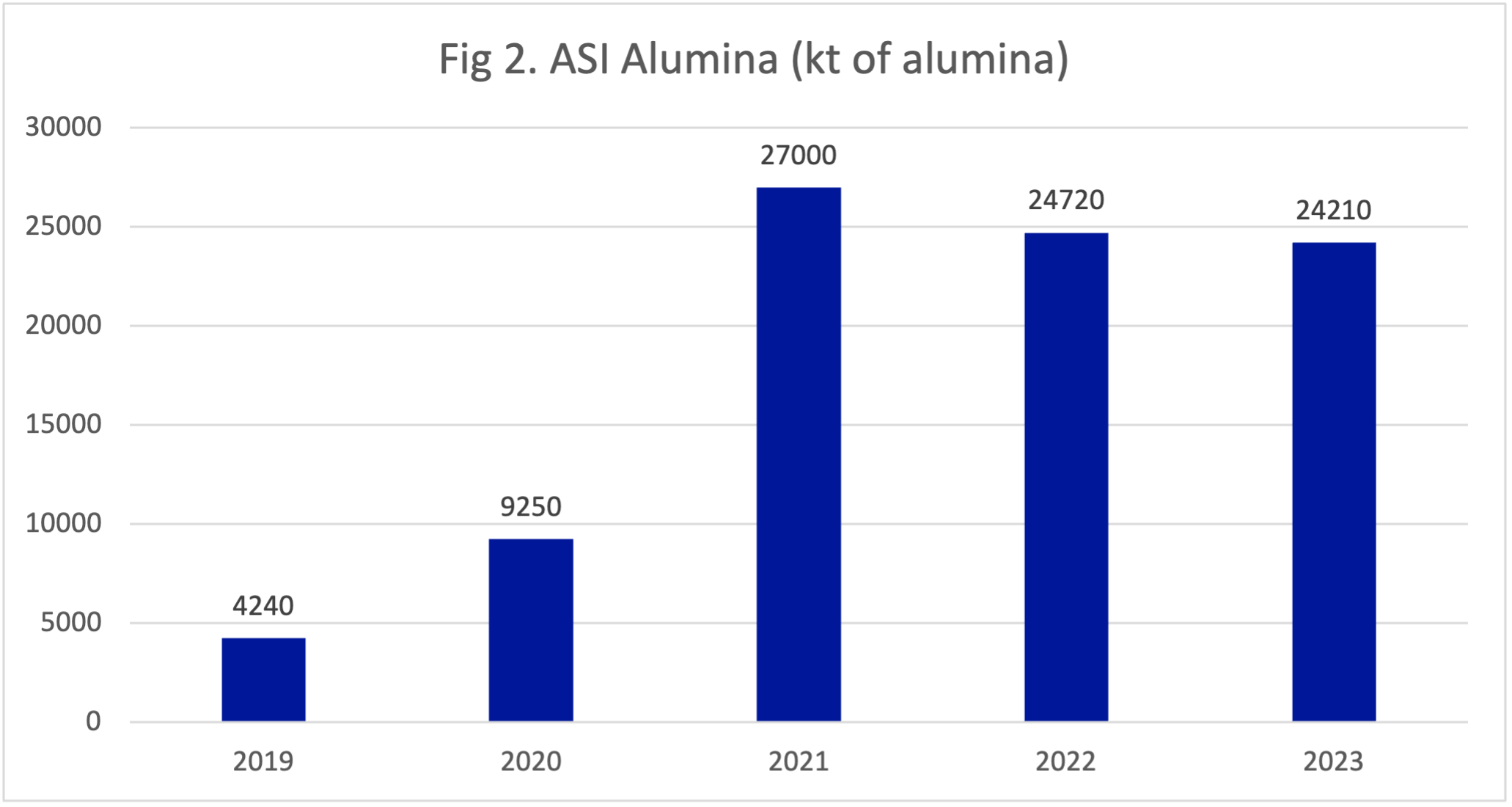

Alumina production

The flow of ASI Alumina from CoC Certified Entities slightly decreased by 2% to 24 Mt of Alumina (see Figure 2), in line with trends in reduced alumina production during 2023 for a number of these Entities.

The flow of ASI Alumina from CoC Certified Entities slightly decreased by 2% to 24 Mt of Alumina (see Figure 2), in line with trends in reduced alumina production during 2023 for a number of these Entities.

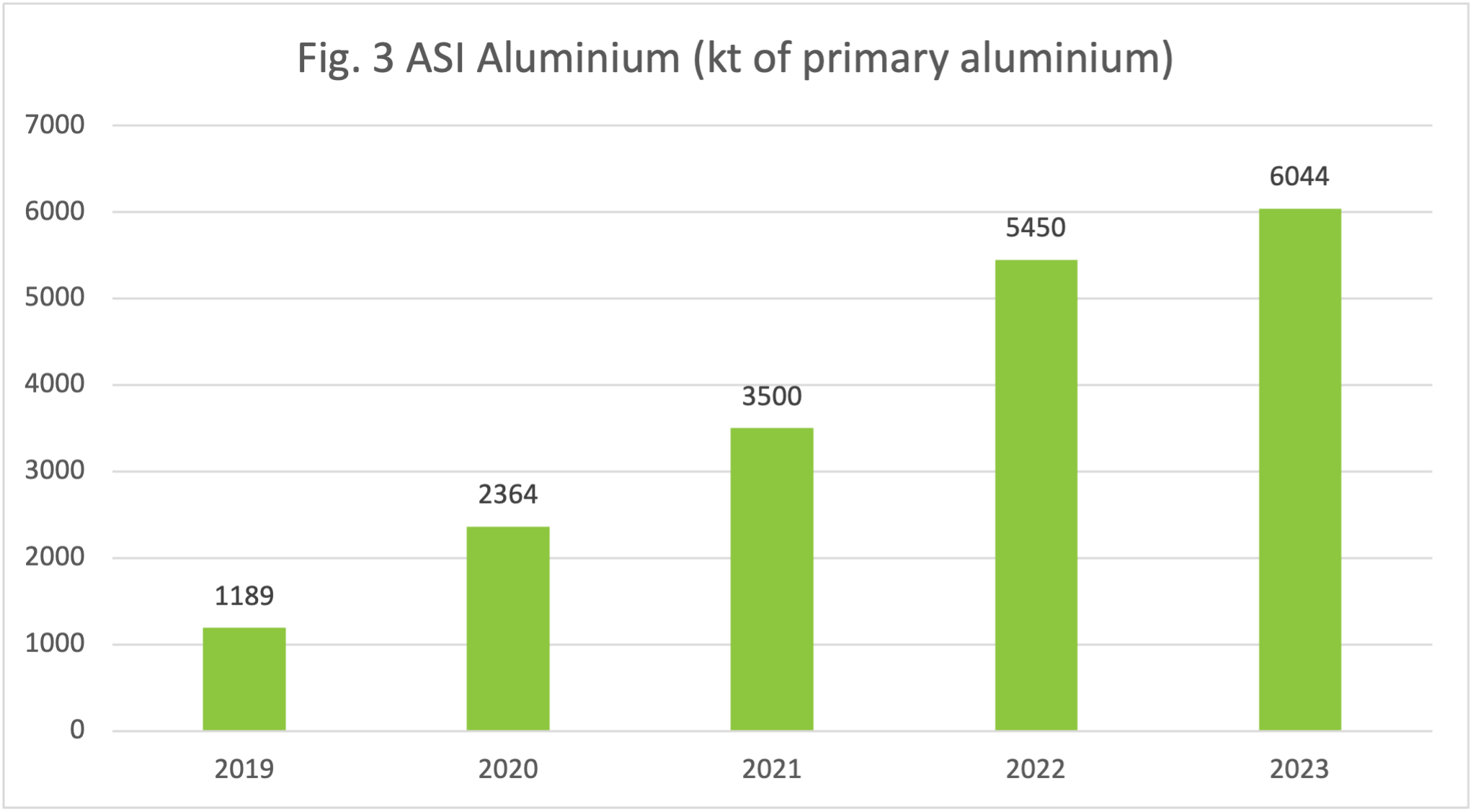

Aluminium production

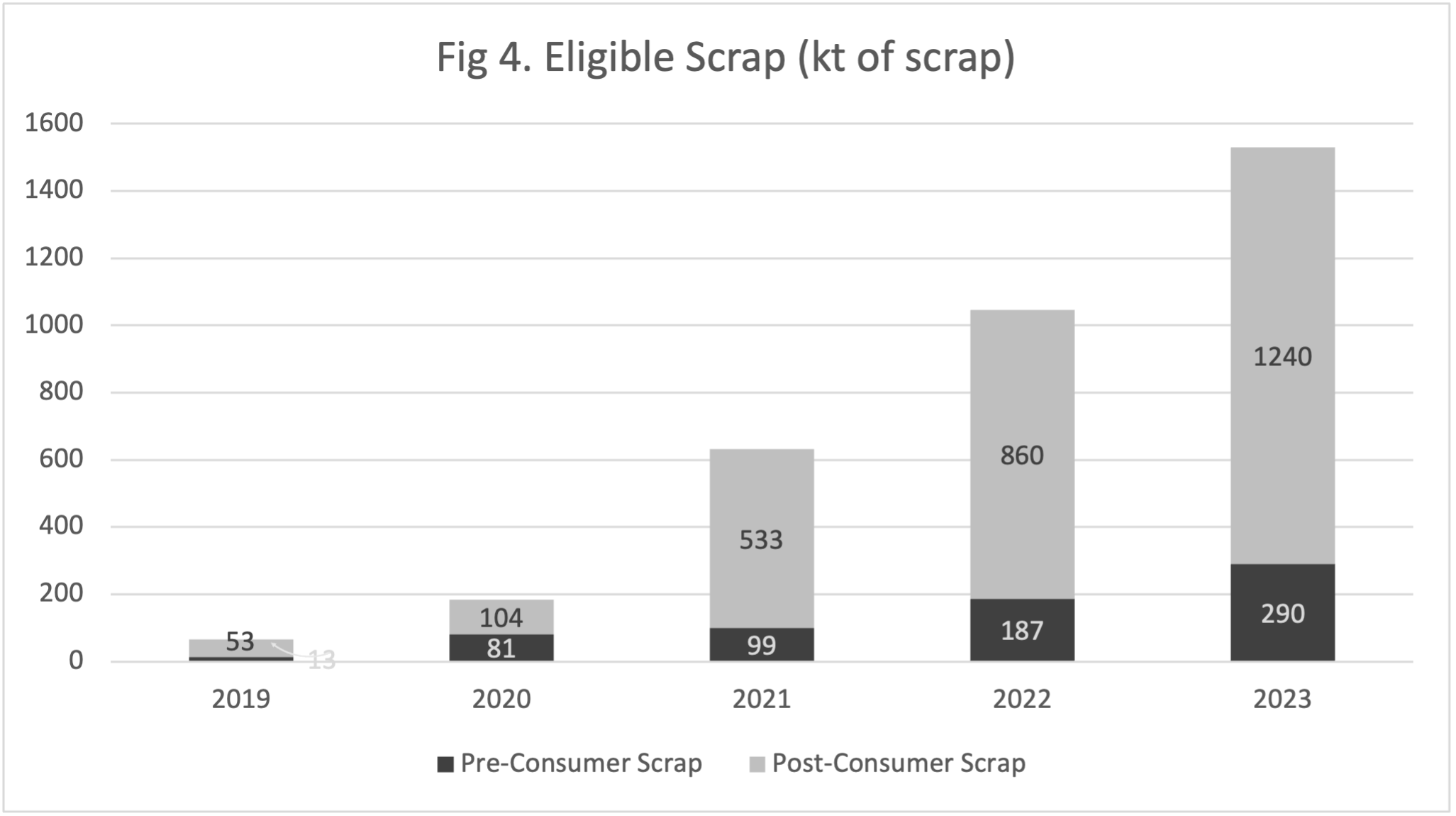

Flows of ASI Aluminium metal (primary and recycled) increased in volume in 2023 (see Figures 3 and 4). ASI Primary Aluminium production increased by 11% year-on-year, and Eligible Scrap inputs increased by 46%.

The data shows that CoC Certified Entities continue to increase their recycling efforts, particularly in the processing of Post-Consumer Scrap. The ASI CoC Standard requires Entities to conduct Due Diligence towards their scrap suppliers, reducing risks associated with scrap collection, sorting and recycling. In 2023, sourcing of Post-Consumer Scrap under the ASI CoC Standard represented nearly 5% of global Post-Consumer scrap supply.

Note that Pre-Consumer Scrap generated and remelted within the same Entity stays in the Entity’s closed loop, so is not required to be reported under CoC Standard and thus is not included in the visualisation.

Flows of Primary ASI Aluminium metal increased by 11% year-on-year.

Flows of ASI Eligible Scrap inputs increased by 46%.

Manufactured goods

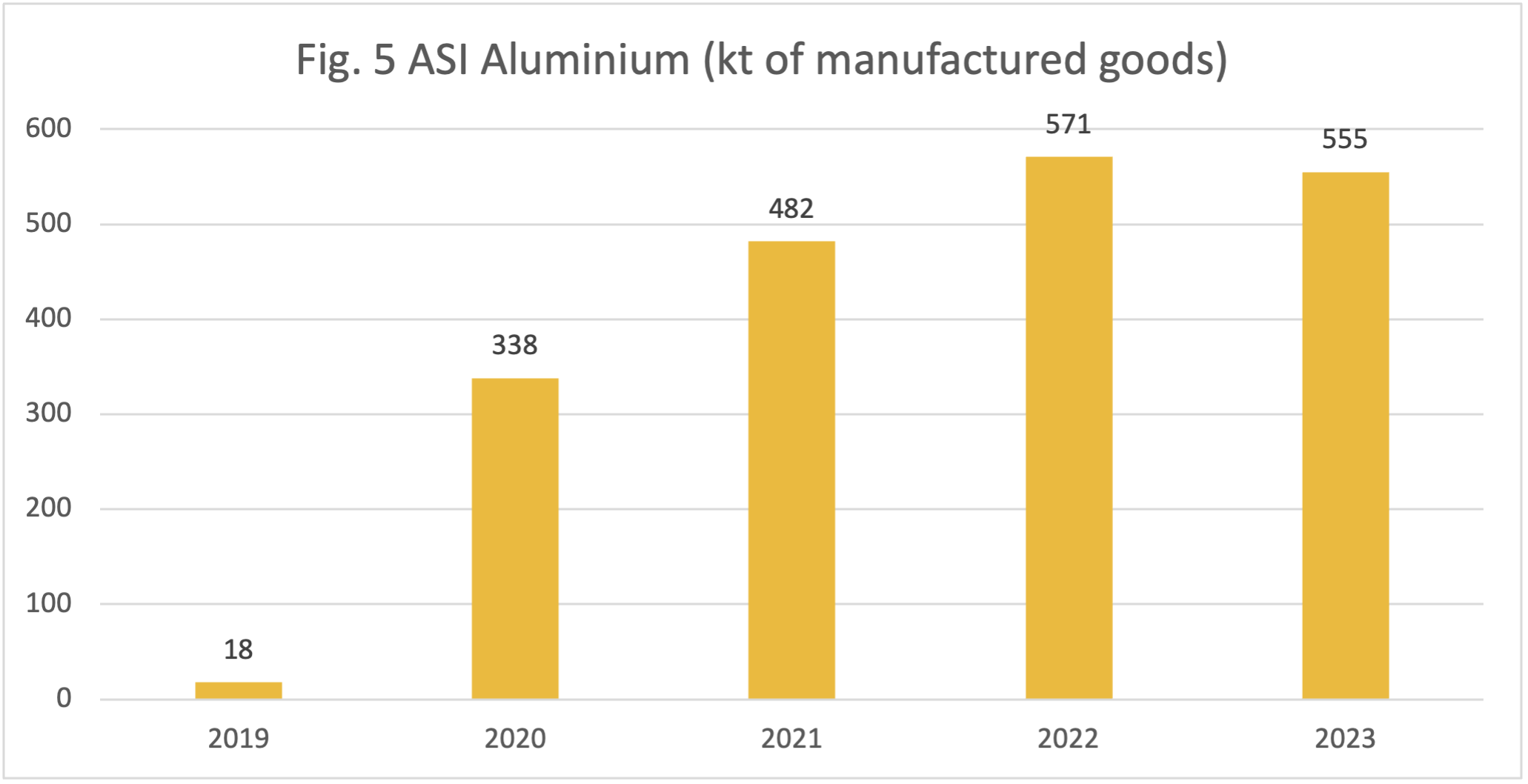

In 2023, the volumes of ASI Aluminium in manufactured goods decreased by 3%, from 571 kt to 555 kt, (see Figure 5). This decrease is mainly because less material was sold at the end of the chain by fully integrated companies.

Regarding product types for manufactured goods, it is estimated that aluminium sheet accounted for the majority of volumes (64%) in 2023.

As part of our 2023 data validation process:

- We identified and addressed an issue in one of the submitted reports for 2023, where an overreporting discrepancy was detected. By reviewing the aggregate flows, we were able to trace and resolve the source of this error. The identification and correction of reporting errors reflects ASI’s commitment to accurate and transparent reporting.

- An error was also belatedly discovered in last year’s reported volumes for finished goods, where one value was incorrectly transcribed from the reporting platform. The error created a higher volume for 2022 that has now been corrected. As a result, the increase in volumes of finished goods containing ASI Aluminium between 2021 and 2022 was around 20% and not more than threefold, as previously reported.

In 2023, the volumes of ASI Aluminium in manufactured goods decreased by 3%, from 571 kt to 555 kt.

Conclusion

While upstream uptake of ASI’s Chain of Custody framework has been very positive, apparent demand for CoC Material after the semi-fabrication stage remains very low. Downstream companies involved in manufacturing are not themselves participating in the CoC system, which means tracking of CoC material largely stops at that point. This creates a challenge for CoC Certified Entities who have invested in their CoC approach with a view of meeting anticipated demand. Yet at the same time, downstream stakeholders are facing expectations for more traceability in supply chains.

As ASI looks ahead to the next revision of its Standards in 2027, we will be considering these and similar tensions for the effort of driving sectoral change at scale. If you would like to share your perspective with us, please contact Chinelo Etiaba.

*We sincerely thank the International Aluminium Institute (IAI) for their collaboration and support and all 79 reporting ASI CoC Certified Entities for their positive engagement with this work.

For more information on ASI CoC Material Flows, contact Klaudia Michalska.

RELATED TOPICS:

SHARE THIS ARTICLE